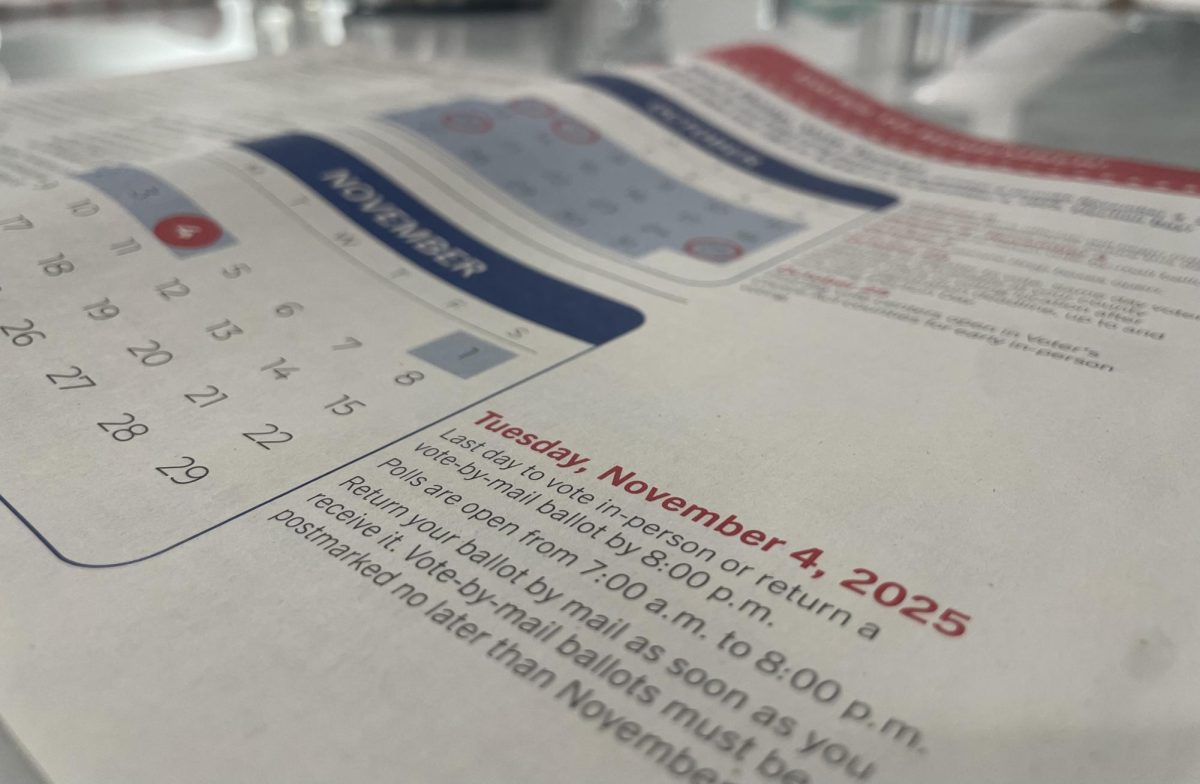

On February 21, a gallon of regular gas at the Del Mar Highlands Mobil gas station was $5.39, an unrealistic and unsustainable price for most Americans. The gas price crisis has plagued elections and politics yearly with seemingly no solution.

Only weeks after entering office though, President Trump announced that his new series of tariffs would not only encourage domestic production and industry but also aid in the “National Energy Emergency” measures he plans to spearhead.

The controversial tariffs originally intended to be established on Mexico, Canada, and China have many Americans hopeful, and many economists fearful.

Tariffs, taxes, or duties — paid on a particular class of imports or exports — have been used to encourage purchasing domestic products and to shield domestic industries.

Although promising at a glance, they come with a hefty cost themselves and have historically only weighed down the prices of items on consumers. For many items that don’t directly compete with a product made in the U.S., the tariffs only increase the price an American consumer will have to pay without incentivizing them to save money by purchasing a version made domestically.

Photo Credit to REUTERS/Elizabeth Frantz (REUTERS/via SNO Sites/Elizabeth Frantz)

“Come make your product in America,” President Trump said at the annual World Economic Forum gathering in Switzerland. “But if you don’t make your product in America, which is your prerogative, then very simply you will have to pay a tariff.”

In many cases, these tariffs serve more to shift the production of items from countries like China with much less stringent labor laws to the U.S., by making it more expensive to continue outsourcing production overseas rather than simply discourage imports.

A specific tariff targeting foreign production of computer chips and semiconductors and an end to the CHIPS and Science Act created by the Biden Administration are some of the measures the Trump administration plans to take to prop up the tech and growing AI industry domestically. The administration has also promised some 6.6 Billion dollars to the Taiwan Semiconductor Manufacturing Co. to aid in the construction of their new facilities in Arizona.

This strategy is one the administration seems to be employing across many industries. “They needed an incentive. And the incentive is going to be they’re not going to want to pay at 25, 50 or even 100% tax,” Trump said.

In response to the promised 25% tariffs on all products from Canada and Mexico, Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum met with Trump to negotiate, according to the BBC.

In response, Trump agreed to a 30-day halt before the tariffs go into action but the threat is still severe. Sheinbaum commented that it was a “good conversation with great respect for our relationship and sovereignty,” whereas China has put in a complaint with the World Trade Organization in retaliation.

Despite this brief pause in development, the economic effects of the tariffs are still looming and many predict steep inflation, rises in gas prices, and even increases in the price of domestic goods.

Economists speculate that inflation may rise to 4.0 from 2.9 percent, according to CBS. NBC reports that many Americans may see a rise in gas prices due to jumps in the price of necessary Canadian and Mexican oil imports. “Economists are saying maybe 50 cents to even a dollar or more,” Mr. Filippone, CCHS AP Government Teacher, said.

Most shockingly to many Americans, increases in the prices of domestic products that are reliant on imports are anticipated as well. For American auto companies, there may be increases in certain parts and vehicles.

“[Tariffs don’t] help them because the parts are coming from Canada and Mexico even if it’s an American car maker like Ford or Chevy,” Mr. Filippone said. A similar effect is anticipated for “large appliances like refrigerators and items like that.”

For example, a computer built with a chip that used to be cheaply imported will become more costly, and to swallow that cost the final computer won’t only cost more to American consumers but also become more expensive and less competitive in foreign markets where that original chip was not heavily taxed.

The bottom line is that these tariffs, although at first glance extremely appealing for discouraging the consumption of unethical labor from overseas and supporting more jobs domestically, may fall short when put into practice.