Biden Forgives Student Loans

US President Joe Biden announces student loan relief with Education Secretary Miguel Cardona (R) on August 24, 2022 in the Roosevelt Room of the White House in Washington, DC. – Biden announced that most US university graduates still trying to pay off student loans will get $10,000 of relief to address a decades-old headache of massive educational debt across the country. (Photo by OLIVIER DOULIERY / AFP) (Photo by OLIVIER DOULIERY/AFP via Getty Images)

In the past 40+ years, college tuition nearly tripled in price. (According to the Department of Education, almost one out of every three American citizens who struggle with student loan debt have not completed their degree due to the high tuition rate.) The combination of 45 million American citizens amounts to $1.6 trillion in student loans. Pell Grants are no longer a tangible source of relief from student loan debt, affecting low-income students heavily as they struggle to obtain a degree. Ordinary affairs such as purchasing homes, receiving retirement funds, and opening businesses are difficult to balance alongside high monthly payments.

During Joe Biden’s campaign for presidency, he vowed to: forgive $10,000 in federal student loan debt for every borrower, nullify the debt of all students from 2-year and 4-year public colleges who earn up to $125,000, as well as expand the Public Service Loan Forgiveness program through the annual cancellation of $10,000 for every year a borrower is employed in a public sector or nonprofit occupation, for a maximum of 5 years. Biden has also proposed to increase Pell Grants and grant free public college education to low-income households that earn less than an annual $125,000.

On August 24, 2022, the Biden Administration announced a three-part plan to revoke $10,000 of student loan debt for low and moderate-income borrowers. (Low and moderate-income borrowers pertain to citizens whose salary sums to less than $125,000 annually.) His plan includes: providing debt alleviation as a countermeasure to the financial liabilities of the pandemic, reducing monthly payments in half for undergraduate loans, and protecting future students by maintaining and reducing college tuitions.

While the news may be words of support for citizens who were unable to be financially independent after burdens of loans were placed on their shoulders, a vast population of American citizens calls for more action to be taken by the President.

American opinions on Biden’s student loan forgiveness plan have varied drastically. Many believe that forgiveness of student debt may cause a spike in inflation; however, multiple studies have shown that loan repayments may positively benefit the economy.

Others have also voiced disapproval of Biden’s student loan forgiveness because of the lack of action, with many believing that the federal government should cancel all student loan debt.

Despite the public debates and conflict, there is an undeniable sense of approval from the majority, knowing that President Biden has fulfilled a vow from his presidential campaign to help aid the country. As time continues to pass, Americans wait to observe Joe Biden’s next move during his presidency, and whether voices will clash or opinions will be in harmony.

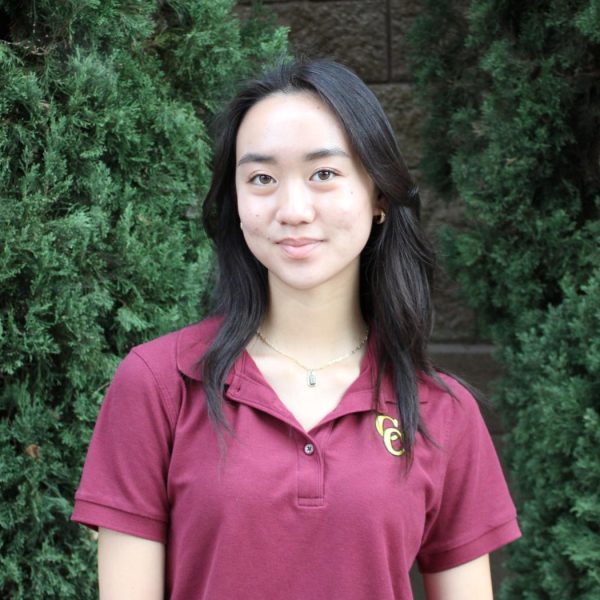

Native to San Diego, Hong-An Phan is a Co- Editor in Chief for Dons Press. After three consecutive years as part of the staff, Hong-An is looking forward...

Neve Walker • Sep 1, 2022 at 11:28 AM

Slay!

Mara Milligan • Aug 31, 2022 at 8:38 PM

Great article!